ri tax rate income

You would have some additional state only deductions and additions apply a single sales apportionment factor to arrive at your RI taxable income. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750.

Complete Edit or Print Tax Forms Instantly.

. More about the Rhode Island Income Tax. This marginal tax rate means. To calculate the Rhode Island taxable income the statute starts with Federal taxable income.

Of the on amount Over But Not Over Pay Excess over 0 66200. More about the Massachusetts Income Tax. Personal Income Tax RI Division of Taxation.

2022 Tax Calculator Estimator - W-4-Pro. RATEucator - Income Brackets Rates. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income.

Discover Helpful Information and Resources on Taxes From AARP. A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate. If you make 140000 a year living in the region of Rhode Island USA you will be taxed 32198.

The state income tax system in Rhode Island. 65250 148350 CAUTION. Your 2021 Tax Bracket to See Whats Been Adjusted.

Ad Calculate your federal income tax bill in a few steps. How many income tax brackets are there in Rhode Island. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1.

In Rhode Island the more you make the more youre taxed. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have. Ad Compare Your 2022 Tax Bracket vs. Rhode Island also has a 700 percent corporate income tax rate.

The Rhode Island Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. DO NOT use to figure your Rhode Island tax. This income tax calculator can help estimate your average income tax rate and your take home pay.

Rhode Island Tax Brackets for Tax Year 2021. Ad Access Tax Forms. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Your average tax rate is 1758 and your marginal tax rate is 24. Interest on overpayments for the calendar year 2021 shall be at the rate of three and one-quarter percent 325 per annum. Any income over 150550 would be taxes at the highest rate of 599.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income.

The income tax is progressive tax with rates ranging from 375 up to 599. Rhode Island taxes most retirement income at rates ranging from 375 to 599. Taxable income between 66200 and 150550 is taxed at 475 and taxable income higher than that amount is.

This page has the latest Rhode. Rhode Islands 2022 income tax ranges from 375 to 599. It is one of the few states to tax Social Security retirement benefits though there are some stipulations around these taxes.

Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 375 475 599 on excess 0 65250 148350.

Levels of taxable income. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

The rate so set will be in effect for the calendar year 2021. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum.

The Federal or IRS Taxes Are Listed. The first 66200 of Rhode Island taxable income is taxed at 375. PAYucator - Paycheck W-4 Calculator.

Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. The range where your annual income falls is the rate at which you can expect your income to be taxed. Detailed Rhode Island state income tax rates and brackets are available on this page.

There are three tax brackets and they are the same for all taxpayers regardless of filing status. All corporations with Rhode Island. Each tax bracket corresponds to an income range.

Taxprof Blog In 2022 Infographic Map Real Estate Infographic Map

State By State Guide To Taxes On Retirees

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Today Quotes

What Are Cvv2 And Cvc2 Numbers Take Care Of Yourself Credit Card Coding

Where Your State Gets Its Money Charts And Graphs Data Visualization Design Data Visualization

Pin By Sherry Szczepanski On Misc Info Understanding Parenting Relationship

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Military Retirees Retirement Retired Military Military Retirement

Charted The U S Metro Areas With The Worst Wage Inequality Business Metroareas Inequality How To Get Rich Chart

Which U S States Have The Lowest Income Taxes Income Tax Income Pinterest For Business

State By State Guide To Taxes On Retirees Kiplinger

What S A Mortgage Recast In 2022 Mortgage Mortgage Lenders Homeowner

Taxes Account For A Large Part Of Cellular Phone Bills Capital Gains Tax Tax Pensions

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Best Places To Move

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

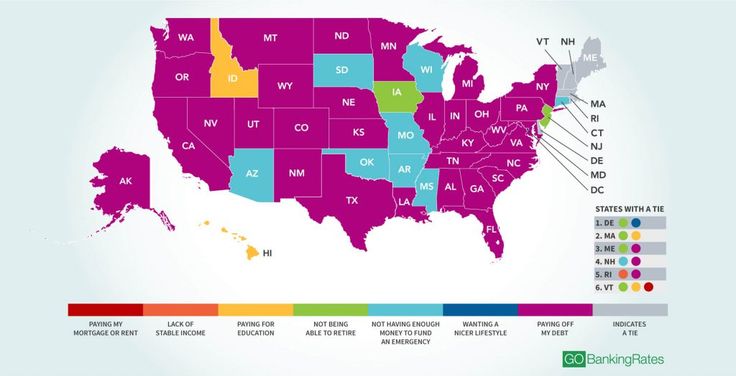

The No 1 Cause Of Financial Stress In Every State

Map Shows The Income Needed To Afford The Average Home In Every State In 2022 Income States Current Mortgage Rates

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Tax Finance Function